Out of the chaos come heroes

Yanxiu Gu, Spécialiste produits, actions chinoises ODDO BHF AM.

” The technology race between China and the US is not going to end any time soon. But investors may miss good opportunities by turning away from these stocks“

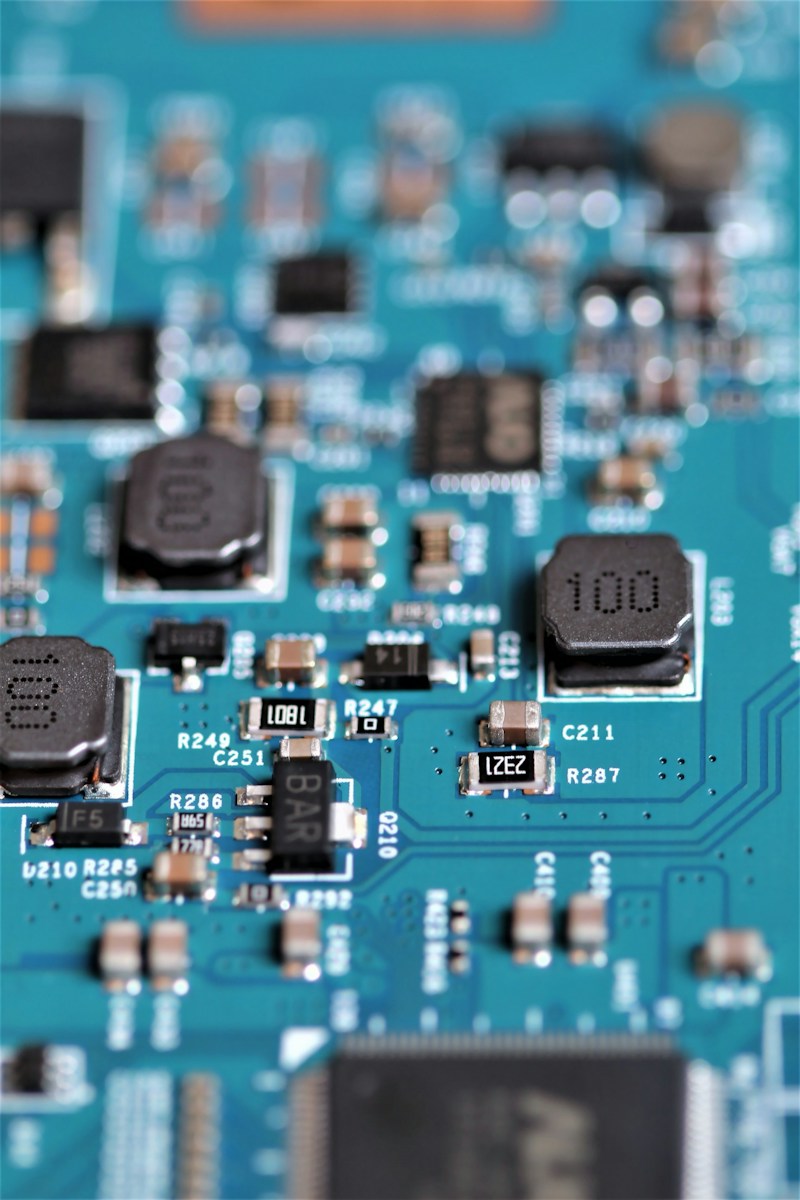

US RESTRICTIONS A PROMPT FOR HUAWEI AND ITS DOMESTIC SUPPLIERS TO INNOVATE

In late August, Huawei, a privately owned Chinese technology giant, launched its new 5G smartphone, the Mate 60 series, equipped with a made-in-China high-end chip, the Kirin 9000s. A Canadian semiconductor technology consulting agency, TechInsights, analyzed the Huawei Mate 60 pro smartphone and found evidence of the presence of a 7nm process technology of the most advanced Chinese foundry, the Semiconductor Manufacturing International Corp (SMIC). Since 2019, the US government has been pressuring US and world-leading semiconductor companies to keep China from acquiring advanced semiconductor technology and equipment. The Dutch semi-conductor equipment giant ASML has since then been prohibited from selling its Extreme UltraViolet (EUV) lithography systems to China, without which, experts believe, China would not be able to fabricate high-end chips (7nms and below). Yet, these sanctions have prompted Huawei to develop chips themselves, boosting the Chinese people’s passion and confidence for Chinese innovation.

TECHNOLOGY BREAKTHROUGH BRINGS HUAWEI BACK TO THE BATTLEFIELD OF SMARTPHONES AND ELECTRIC CARS

Thanks to this breakthrough, Huawei is taking away more domestic market share from its key competitor, Apple. Huawei used to be the second largest smartphone maker in the world, and the largest one in China, but it has had tough years since the US government put it on the sanctions list in 2019. With the launch of its latest smartphones, Huawei is very likely to win back the number 1 position in China. In the first week of October, sales of Huawei’s smartphone overtook those of Apple, Honor and Xiaomi and it became the most popular one.

Thanks to the success of Kirin 9000s chip, Huawei’s new electric cars are also gaining favor with local consumers, beating Huawei’s own expectations. Electric cars are like huge PCs and smartphones, with 1000 to 3000 chips per vehicle.

Early this year, we published an article on China’s electric cars, where we mentioned that Huawei had entered this hot field. But at that time, both analysts and investors were not sure about Huawei’s competitive advantage versus well- renowned brands like BYD, Tesla, Li Auto, etc. However, Huawei’s breakthrough with Kirin 9000s has raised consumer confidence in its products considerably. Huawei’s new electric SUV M7, launched two weeks after the new smartphone, immediately became a strong competitor to other Chinese electric car brands, adding fuel to the already intense competition on the domestic electric car market. Within 25 days, Huawei had received more than 50,000 electric car orders, whereas Huawei’s initial business plan was 8,000 cars per month.

A BOOST FOR TECHNOLOGY SUPPLIERS

The stock prices of Huawei’s domestic suppliers have been rising since the launch of Mate 60 series, as they are considered beneficiaries of the rising demand for both smartphones and electric cars. For example, the stock price of Huawei’s camera module supplier OFIUM, which was the supplier of the US technology giant Apple until 2020, nearly doubled within six days after the launch of Huawei Mate 60. The stock price of Seres Group, Huawei’s electric car manufacturing partner, has also jumped by around 153% since end of August*. Lastly, SMIC, who hasn’t been officially confirmed to media as the chip manufacturer of the Kirin 9000s, has also seen its stock price rise by 27% since the launch of the new phone, vs. “only” 8% for Chinese semiconductor sector*.

IS IT WORTH CHINA’S WHILE TO FABRICATE HIGH-END CHIPS? THE QUESTION IS LESS IMPORTANT THAN YOU THINK

Without access to the most advanced lithography equipment, due to US’s restrictions, China’s breakthrough in 7nm chips may be very expensive. But I believe investors should care more about another question than about the current cost of making the Kirin 9000s. The true question is: how much cost is the Chinese government ready to pay to move forward in the semi-conductor industries? The answer is: no limit.

Before the US sanctions on Huawei, Chinese companies were not very willing to invest in innovation. Why bother spending huge money on risky innovation while you can simply buy it? But today, those companies have come under broad criticism, accused of having been naive, and the Chinese government is determined to support companies and researchers to accelerate breakthroughs. For Chinese companies, lower, or even negative, margins are not going to stop them from moving forward, as long as they continue to receive financial and regulatory support from the Chinese government. According to Reuters, the Chinese government will create an additional 300- billion-yuan (US$41 billion) fund to revitalize the semiconductor industry.

THE MORE BREAKTHROUGHS THERE ARE, THE MORE US RESTRICTIONS THERE ARE. AND THE MORE US RESTRICTIONS, THE MORE DOMESTIC ORDERS

The Kirin 9000s 7nm chip is a milestone in China’s battle against the harsh US restrictions. China believes that it will be able to overcome the challenges, with significant capital, a talent pool, and massive domestic demand, since it is the largest semi-conductor market in the world. China’s massive domestic demand made it possible for many emerging sectors, such as photovoltaics and electric cars, to reach economies of scale earlier than expected.

China’s breakthroughs will probably be met with more stringent restrictions. On 17 October 2023, the US Commerce Department announced harsher export restrictions on China’s semi- conductor industry. In addition to Nvidia’s most advanced A100 and H100 chips, the “less advanced” A800 and H800 chips, specially designed for Chinese market, may be banned as well.

However, foreign suppliers are losing Chinese market share to local suppliers. Now that the US government restricts Chinese technology companies to buy the most advanced technology and equipment, local technology companies, such as Huawei, Alibaba and Baidu, have to turn to local suppliers. According to Huatai Securities, nearly half of all machinery equipment tenders by Chinese foundries this year have been won by local players.

INVESTMENT OPPORTUNITIES: LOOK UP ALONG THE INDUSTRIAL CHAIN

Chinese governments will continue to provide huge financial and regulatory support to local companies, just as the Taiwan government has nurtured TSMC, the world leading semi-conductor chip manufacturing company, since the 1970s.

The US’s restrictions on technology exports to China is painful for Chinese downstream technology players like Huawei, who must bear with high costs to make innovation progress, but Chinese upstream players and equipment suppliers are clear beneficiaries.

For example, Advanced Micro-fabrication Equipment Inc. China (AMEC), China’s leading integrated circuit etching equipment supplier, has seen its stock price rise by 63% YTD (as of 18 October 2023). From 2017 to 2022, the compound annual growth rate of AMEC’s revenue and net income reached 37% and 108%, respectively. Both Chinese and the world’s leading semi-conductor companies are its clients. Its latest 5nm etching machine has been adopted by TSMC.

The technology race between China and the US is not going to end any time soon. But investors may miss good opportunities by turning away from these stocks. As an old Chinese proverb says, out of chaos come heroes.