Generative AI and ChatGPT have captured the public imagination. Asset managers have been watching developments closely too.

David Wright, Head of Quantitative Business Strategy & Stéphane Daul, Senior Quantitative Analyst Pictet Asset Management.

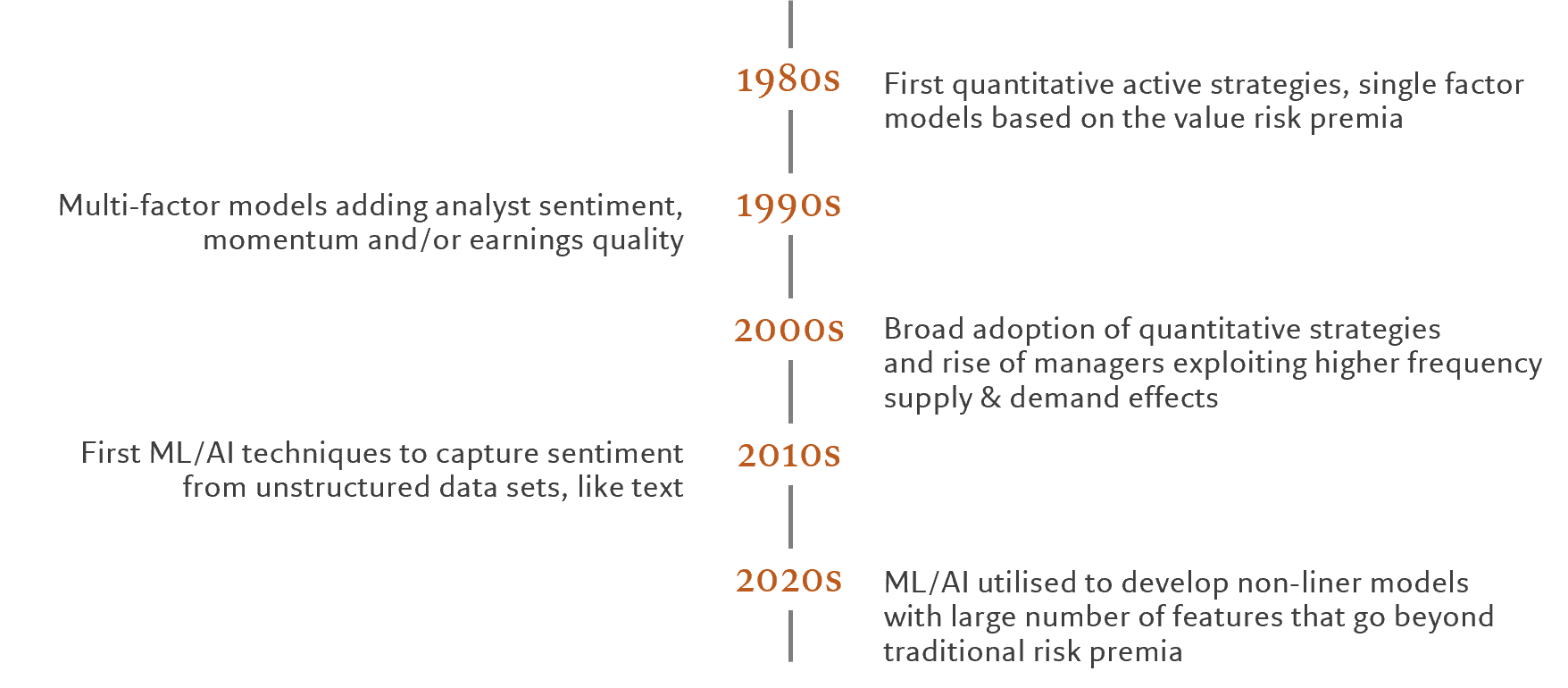

Machine learning (ML) is being hailed as a better way to pick stocks. Yet in practice, the benefits of using ML and artificial intelligence (AI) in portfolio construction will manifest themselves in several different ways; their deployment is, in our view, simply the latest phase in the long evolution of quantitative investing.

Key takeaways

Why asset managers should use artificial intelligence?

Artificial intelligence can be used to extract signals and patterns from varied data source, enabling more accurate investment forecasts. But its application also goes way beyond stock selection, ranging from controlling risk, lowering trading costs or optimising positioning.

How to overcome the challenges associated with it?

The assumption that investors can accept AI as a black box no longer holds. There is a need to decompose features, positions, risks and performance of the underlying inputs, which we deeply looked into by analysing our own excess returns.

What does artificial intelligence require?

A robust ML/AI platform is crucial to overcome the challenges presented by the usage of AI. This should be equipped with specific tools that ensure reproducibility, version control, scalability, and compliance.

Artificial intelligence applications within a portfolio

The digitalisation of the world economy has led to an explosion in available data, both the structured kind – such as financial data reported by corporations – and the unstructured kind such as text, video files and images. How to analyse and combine this data using ever larger models is proving to be both a major challenge and opportunity for quantitative portfolio managers.

ML helps on several fronts.

- Artificial intelligence can be used to extract signals and patterns from varied data sources

ML based on natural language processing (NLP), for example, can be used to analyse sentiment towards companies within news articles, sell-side analyst reports or earnings call transcripts. This is especially useful for quantitative portfolio managers who, unlike company analysts, often do not have meetings company executive and therefore risk missing out on ‘softer’ signals that can have a bearing on stock performance. Deployed well, NLP techniques used to analyse earnings call transcripts can often identify relevant information not contained within the official earnings release.

2. Artificial intelligence enables more accurate investment forecasts

Advances in AI allows for more accurate forecasts for individual stocks than traditional factor investing. Traditional factor investing is designed to exploit risk premia – investment signals that are grounded in economic theory and backed up by empirical research. Aided by advanced ML, Quant 2.0 enables portfolio managers to identify anomalies that extend beyond these premia. In our AI-driven stock selection model, for example, the separation of this process from our analysis of traditional risk premia – which occurs at each step in the portfolio’s construction – is one of the key innovations in our approach. These anomalies will often be found over shorter time horizons of, say, less than a month, a period in which investors’ positioning and market activity has a more powerful influence on stock returns than macro-economic forces or company fundamentals. Varied data sources can often offer a guide to changing behaviour. AI allows us to combine hundreds of features and capture the relationships and interactions between the data to make more accurate forecasts.

3. Artificial intelligence applications goes way beyond stock selection

The new machine learning can be applied beyond stock selection, incorporating multiple time horizons with the aim of controlling portfolio risk, lowering trading executions costs and to optimise portfolio positioning. This is further developed in a research paper published in Quantitative Finance by our quantitative investment manager Thibault Jaisson, Deep differentiable reinforcement learning and optimal trading.

Fig 1. Adoption of ML/AI within quantitative investing is part of a longer term evolution:

Transparency is key when using machine learning to invest

Many recent research papers have attested to the superior stock return predicting power of ML models.

But, in practice, employing AI-based models in investment is fraught with complexity and risk. The assumption that investors can accept AI as a black box no longer holds. There is a need to decompose features, positions, risks and performance of the underlying inputs. Transparency is crucial, which our quantitative team deeply looked into in a paper called Performance attribution of machine learning methods for stock returns prediction published in The Journal of Finance and Data Science.

What did our own returns decomposition analysis find?

First, that a part of the excess return from AI-driven models comes from strategies such as ‘reversal’, namely those stocks that, because of a particular return pattern, are likely to reverse direction, or ‘short-term momentum’, stocks that will continue on their present trajectory. These are strategies that are employed by statistical arbitrage managers in traditional models.

Another part of the excess return comes from having a much larger number of features than can be effectively utilised in traditional quantitative models. Traditional models typically analyse tens of such features. Yet AI-powered ones can process hundreds of them and are also able to allocate greater weight to the features that have the highest positive impact on returns.

The final portion of the excess return stems from the interaction effects between the features that form part of the analysis. For example, stocks that enjoy positive analyst sentiment and low short interest – where only very few hedge funds hold a short position in it – will behave differently to shares for which the opposite applies.

Human judgement is still essential in deployment of artificial intelligence

Creating an ML model that is reliable, fast, accurate, and that can be continuously monitored and adapted over time is complicated and time consuming. ML models rely on a large amount of data, which makes it difficult for individual portfolio managers and analysts to monitor.

“One portfolio manager is not enough. You need a robust platform to use ML/AI when investing”

Stéphane Daul, Senior Quantitative Analyst

ML/AI models:

- Require managers to make several tweaks, and as small changes can lead to enormous differences in the results, such changes need to be constantly evaluated.

- Rely on real-world data for predictions, so as real-world data changes, so should the model. This means that we, as portfolio managers, have to keep track of new data changes and make sure the model learns accordingly.

To overcome these challenges, a robust ML Operations platform is essential. This should be equipped with specific tools that ensure reproducibility, version control, scalability, and compliance.

The deployment of ML/AI in portfolio construction requires a seamless collaboration between engineers, data scientists and fund managers, all of which aimed at creating a transparent decision making process capable of delivering alpha.